(reverse)

STOCK SPLIT ARBITRAGE

Reverse stock split arbitrage with fractional share round up is a niche trading strategy that aims to generate a small, low-risk profit by exploiting a specific corporate action: a reverse stock split where fractional shares are rounded up to the nearest whole share.

Understanding the Core Concepts

First, let's break down the key terms:

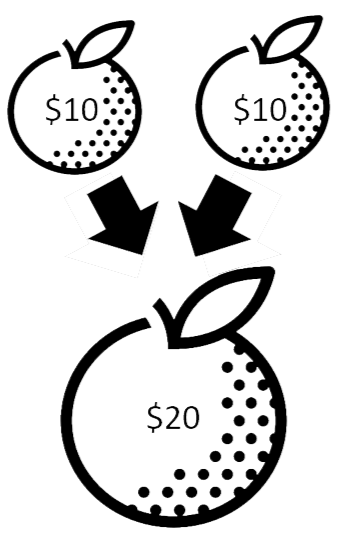

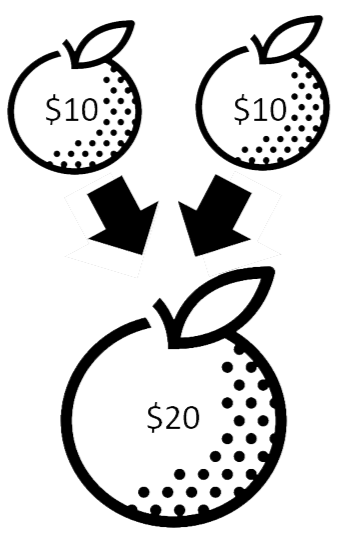

Reverse Stock Split: This is a corporate action where a company reduces its number of outstanding shares, which in turn increases the price per share. For example, in a 1-for-10 reverse split, an investor holding 100 shares would have 10 shares after the split, but each share would be worth ten times as much. Companies often do this to increase their stock price and avoid being delisted from a stock exchange.

Fractional Shares: These are portions of a whole share of a company's stock. They can arise from various corporate actions, including reverse stock splits. For instance, if you owned 15 shares in a 1-for-10 reverse split, you would be left with 1.5 shares.

Fractional Share Round Up: In some reverse stock splits, the company will have a provision to round up any resulting fractional shares to the next whole share. In the example above, your 1.5 shares would be rounded up to 2 whole shares. This is the key element that creates the arbitrage opportunity.

Arbitrage: In finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices. In this context, it's about exploiting the "free" fractional share provided by the round-up.

The Arbitrage Strategy in Action

The strategy is to identify companies that have announced a reverse stock split with a fractional share round-up provision. An investor would then purchase a small number of shares—often just one—before the reverse split takes effect.Here's a simplified example:

Identify the Opportunity: Company XYZ announces a 1-for-100 reverse stock split. The company's press release or SEC filings state that all fractional shares will be rounded up to the nearest whole share. The stock is currently trading at $0.10 per share.

Execute the Trade: An investor buys one share of XYZ for $0.10 (plus any commission fees).

The Reverse Split Occurs: After the reverse stock split, the investor's single share is converted. According to the 1-for-100 ratio, their holding becomes 0.01 shares.

The Round-Up: Because of the round-up provision, the 0.01 fractional share is automatically rounded up to one full share of the new, post-split stock.

Realize the Profit: The new share price should theoretically be 100 times the pre-split price, so around $10.00. The investor can then sell their single share for a significant profit, having turned an initial investment of just $0.10 into $10.00.

Finding These Opportunities

Identifying companies planning a reverse stock split with a round-up provision requires some research. Investors can typically find this information in:

Company Press Releases: These are often the first place a company will announce a corporate action.

SEC Filings: Official documents filed with the Securities and Exchange Commission, such as a proxy statement (DEF 14A), will detail the terms of the reverse stock split, including the treatment of fractional shares.

Financial News Outlets and Stock Screeners: These resources often track and report on upcoming corporate actions.

Risks and Important Considerations

While this strategy appears to offer a straightforward profit, there are several risks and challenges to consider:

Broker Treatment of Fractional Shares: This is the most significant risk. Not all brokerage firms will honor the company's round-up provision for their clients. Some brokers may instead pay cash in lieu of the fractional share, which would negate the arbitrage opportunity. This is particularly true for brokers that hold shares in "street name" (meaning the broker is the registered owner, and the investor is the beneficial owner). In such cases, the broker receives the round-up on its total holdings and may not pass it on to individual account holders. It is crucial to check with your specific broker about their policy on reverse stock splits and fractional shares.

Stock Price Volatility: Reverse stock splits are often undertaken by companies in financial distress. The announcement and execution of a reverse split can lead to significant price volatility. The stock price could fall between the time you purchase it and when you are able to sell the rounded-up share, potentially erasing your profit.

Liquidity: The stocks undergoing reverse splits are often thinly traded. This lack of liquidity can make it difficult to buy or sell shares at your desired price.

Transaction Costs: Brokerage commissions and other fees can eat into the potential profit, especially since the initial investment and the potential gain are relatively small on a per-transaction basis.

"Odd Lot" Holders: Some companies may have provisions that treat "odd lot" holders (those with fewer than 100 shares) differently. It's essential to read the fine print of the reverse split announcement.

Regulatory Scrutiny: While not illegal, if this strategy were to become widespread, regulators or companies might take steps to close this loophole.